Get exemplary benefits & exemptions with Startup India Certificate

Every Startup Company with innovation & unique business ideas can apply for the Startup India Certificate issued by DPIIT.

Startups will enjoy several privileges offered under Startup India Scheme.

Why Choose Us

Startup India Certificate by practicing Chartered Accountants

Correct section & DTAA applicability analysis

Accurate tax rate & withholding computation

Complete remittance compliance under FEMA & Income Tax

End-to-end professional certification support

What is the Startup India Certificate of Recognition?

With a view to boost the Indian economy and encourage entrepreneurship, the Government of India, under the administration of the Ministry of Commerce & Industry, had begun the Start-up India Stand-up India initiative in 2015 to uplift and grow the Indian start-ups.

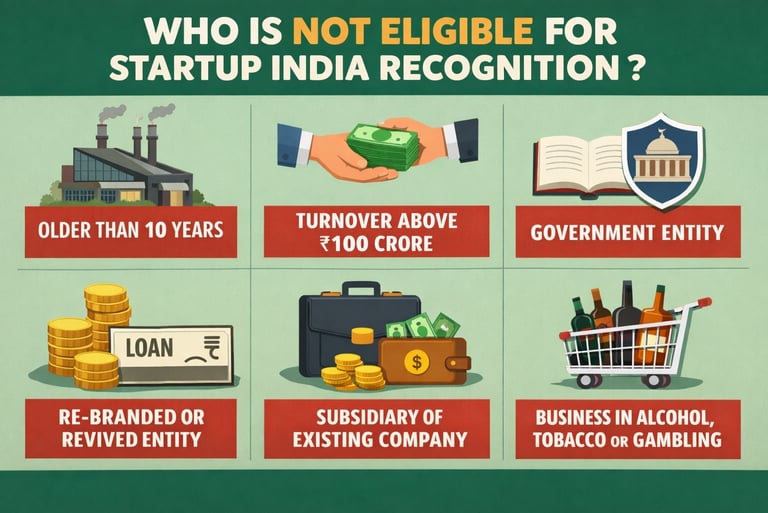

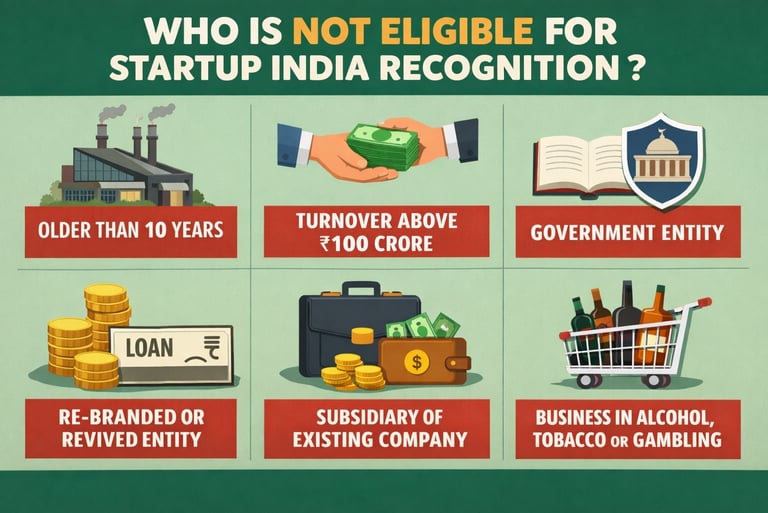

Who is not eligible for Startup India Recognition?

1. Sole Proprietorship

2. Firm constitute by the notary partnership deed

3. Once annual turnover exceeds INR 100 crores

4. Company is older than 10 years.

Eligibility criteria for Startup India Certificate

The Startup should be a

1. Private limited company or

2. Registered Partnership firm or

3. Limited liability partnership

The company should be newly incorporated and should not be formed by splitting up or reconstruction of an existing business.

Turnover should be less than INR 100 Crores in any of the previous financial years.

An entity shall be considered as a startup up to 10 years from the date of its incorporation

The business concept should be unique driving towards innovation or bringing improvement of existing products, services and processes and

A startup should have the potential to generate employment/ create wealth.

3 layers of Startup India Certificate Recognition

1. Issuance Of Startup India Certificate

On receipt of an application, DPIIT issues a Startup India certificate to the newly incorporated company after validating the unique business process and other eligibility criteria.

2. Angel Tax Exemption On Equity Investment

An investment made on startup by investors on the premium is exempt from tax u/s 56(2)(viib) of the Income Tax Act if a startup is further approved by the Inter-Ministerial Board.

This exemption is valid till startup paid-up share capital + share premium does not exceed INR 25 crore.

For availing angel tax exemption, a startup needs to file a declaration under Form-2 to DIPP.

3. Income Tax Exemption

The startup will get any 3 consecutive years tax holiday out of ten years tenure.

For income tax exemption u/s 80-IAC, Startup needs to file a separate application under Form-1 and the Income Tax authority shall grant the certificate or reject the application.

This application can be filed only after the issuance of a Startup India Certificate.

The validity of Startup India Certificate

An entity shall cease to be a Startup on completion of ten [10] years from the date of its incorporation/ registration

or

If its turnover for any previous year exceeds one hundred [100] crore rupees.

Whichever is earlier.

Startup India Certificate Verification

Once applied for the startup india registration, you will receive an acknowledgment receipt number (ARN) for tracking your certificate status.

Once your Startup India application is successfully processed, you can easily download your Start-up India certificate.

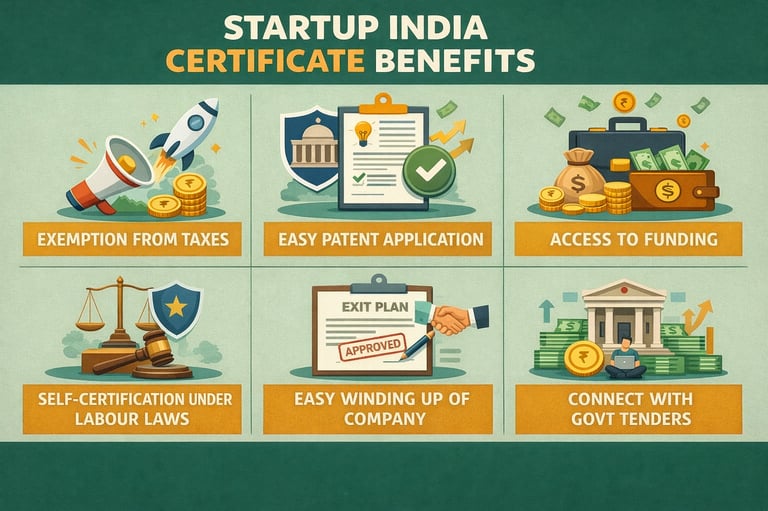

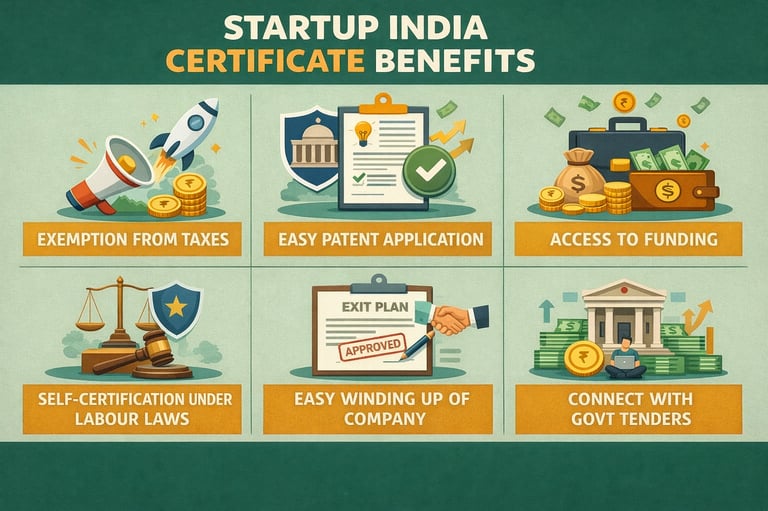

Startup India Certificate Benefits

TAX EXEMPTION U/S 80 IAC

Post getting recognition under startup India scheme, you may apply for Tax exemption u/s 80 IAC of the Income Tax Act.

A Startup can avail tax holiday for 3 successive financial years during its first 10 years of startup eligibility.

Criteria for applying to 80IAC Tax exemption :

#1. Must be a recognized Startup

#2. Only Private limited or LLP is eligible

#3. Must be incorporated on or after 1st April, 2016

# ANGEL TAX EXEMPTION U/S 56

After startup india registration, you may apply for Angel Tax Exemption.

Criteria for Angel Tax Exemption u/s 56 of the Income Tax Act 1961:

1. The entity must be a DPIIT recognized Startup

2. Aggregate amount of paid up share capital & share premium after the proposed issue of shares, must not exceed INR 25 Crore.

SELF-COMPLIANCE FOR LABOUR LAWS

Startups can do self assessment for labour law compliances and there will be no inspection or physical visit by public officers during the first 3 years. Startups can self-certify through startup india portal with given below 6 labour laws.

1. Inter-State Migrant Workmen laws

2. Gratuity Laws

3. Provident Fund Laws

4. Employee State Insurance laws

5. Other Constructions Worker laws

6. Contract Labour laws

Our professionals can assist In order to self-certify labour laws compliances.

Click here to download Self-certification formats for compliance under Labour Laws Startup India.